Nike-owned RTFKT became web3â²s latest casualty this week, when the virtual sneaker and fashion brand announced it would cease operations by the end of January.

The company didnât cite a reason, and Nike hasnât made any public comment on the decision. But itâs no mystery why the unusual partnership didnât work out.

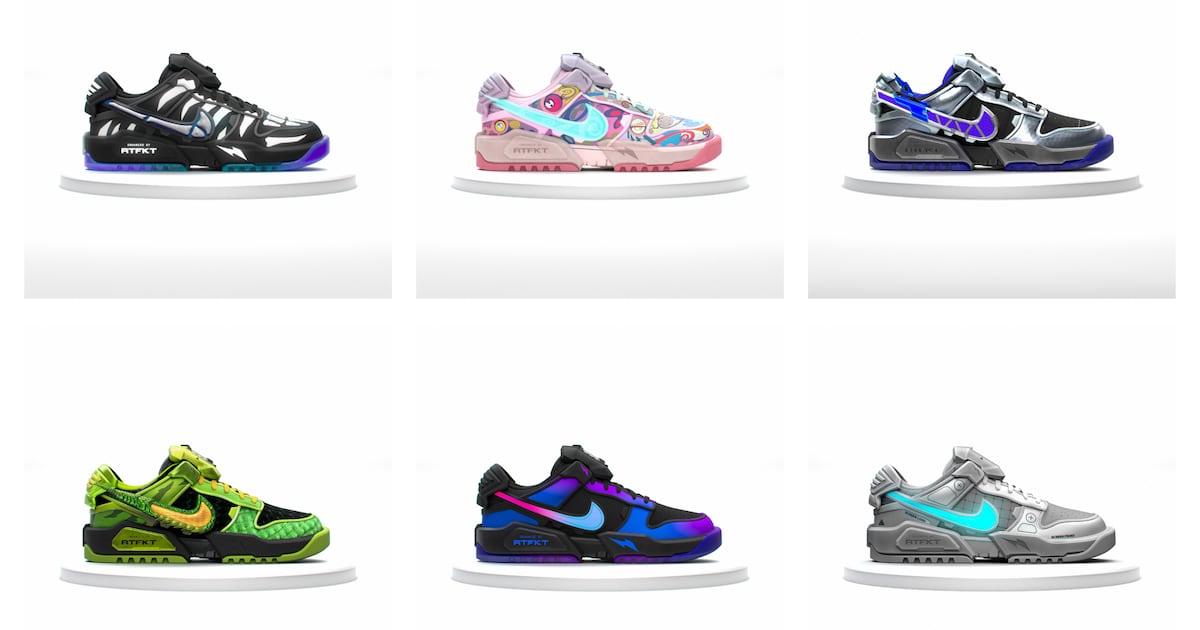

In the three years since its surprise acquisition, Nike was never able to articulate how RTFKTâs virtual sneakers tied into its core business of selling very real shoes. And so it remained a side project, spinning out digital goods for a small fanbase, with occasional ventures into the real world, including Nike Dunks transmuted through the lens of video games that came equipped with chips connected to a digital collectible.

At the time of the purchase, John Donahoe, a former tech executive who was about a year into his tenure as Nike CEO, was betting on a future where shoppers would spend ever-larger amounts of cash on virtual goods in video games and other digital environments. Web3 proponents argued minting those goods on the blockchain as NFTs offered a way to prove digital ownership, in theory laying the foundation for a thriving new type of virtual economy. Back in 2021, RTFKT was a leader in the space, making millions on sales of sneaker NFTs and online avatars designed by artist Takashi Murakami.

Nike would introduce its own web3 platform, .SWOOSH, in 2022. But interest in the concept waned and the market value of most NFTs plummeted. When Nike veteran Elliott Hill replaced Donahoe at the top amid a worrying slide in sales, RTFKT was an easy target.

Nike isnât the only fashion company backing away from flashy side projects taken on in better times. Moonshot ventures are giving way to more practical goals as brands reassess their appetite for risky tech investments in a challenging economic climate where consumer spending patterns are increasingly oriented around discounting. LVMH, which last year sold a $41,000 NFT of a Louis Vuitton trunk, is focussing its tech investments these days on less-showy behind the scenes tasks, including an internal AI-powered chatbot for employees. American Eagle acquired an e-commerce logistics start-up in 2021 for $350 million with ambitions to become a leader in that space; earlier this year it wrote down that investment and said it would focus on order fulfillment at its own brands.

Adventures like Nikeâs RTFKT purchase raise questions about how brands should approach unproven technologies like web3, and innovation generally.

While web3 isnât dead, it has suffered greatly. Yuga Labs, the company behind the once-buzzy Bored Ape Yacht Club, has conducted multiple rounds of layoffs and restructured earlier this year. The prominent NFT marketplace OpenSea, which investors previously valued at more than $13 billion, has seen its implied value plunge some 90 percent since 2022. The hope that NFTs could be a foundation for lasting new brands feels all but dashed.

But thatâs not to say blockchain technology itself is going away. Leaving aside Bitcoinâs recent surge past $100,000 as the industry anticipates a crypto-friendly Donald Trump presidency, luxury brands and others have been using blockchain to create digital product passports for millions of items while the EU gears up to mandate different goods have virtual identities in a push for greater corporate transparency. This work began during the height of the web3 boom, and continued even after the crash.

This use of technology may not be as eye-catching as dropping a collection of high-priced, branded NFTs, but it attempts to solve an actual problem, which is often where innovation is most useful.

Why then do so many brands keep falling for the empty hype? The trouble with new innovations is their value isnât always clear at first glance. The industry remains scarred by its slow embrace of online shopping. When e-commerce first came along, many fashion brands famously resisted selling online, leaving them hustling to catch up later as consumers proved they were willing to buy goods, even luxury ones, without being able to touch them.

It can leave brands in a conundrum: Rush in and potentially make a costly mistake, or hang back and risk being late.

These same debates are now taking place around generative AI, which depending on your perspective, is either the next big leap forward in technology or a clever tool capable of neat party tricks with limited real-world use. Maybe the most obvious application in fashion is a ChatGPT-like online shopping assistant capable of interacting with shoppers, answering questions and providing recommendations. The technologyâs biggest impact could ultimately be less dramatic though, like improving online personalisation, quietly powering design platforms and writing web or marketing copy.

At the moment, the appetite for high-profile projects that seem as much about the headlines they generate as the business case behind them looks low, given the uncertain market and jaded consumers whoâve seen the ânext big thingâ come and go one too many times.

What brands have to consider is whether they think an innovation is going to change the landscape and create new rules of its own, the way e-commerce did, or if not, how it can add value in the world that already exists.

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

The tally of US Shoppers slipped during Thanksgiving weekend. An estimated 197 million people shopped from Thanksgiving and Black Friday to Cyber Monday, according to the National Retail Federation and Prosper Insights & Analytics. Thatâs 1.7 percent lower than last yearâs record of 200.4 million.

Overall Black Friday sales marked a solid kickoff to the holiday season. In-store and online sales rose 3 percent year-over-year on Black Friday, according to data from Mastercard. The five-day period from Thanksgiving to Cyber Monday brought inâ¯$41.1 billion in online sales, upâ¯8.2 year-on-year, according to Adobe Analytics.

Lululemon raises annual forecasts betting on robust holiday sales. The activewear brand now expects fiscal 2024 revenue of at least $10.45 billion, up from its prior forecast of $10.38 billion at the lower end of its range, it announced Thursday, sending shares up about 5 percent in extended trading.

PVH Corp. beats Q3 revenue estimates, maintains full-year guidance. The Calvin Klein and Tommy Hilfiger owner saw shares fall after it reaffirmed prior guidance of revenue declining 6 to 7 percent for the year. It reported revenue of $2.26 billion, down 5 percent year-over-year.

LVMH luxury fund invests in Norwegian luggage brand Db Bags. Its new minority stake marks LVMHâs second investment in the travel accessories space, after scooping up 80 percent of Rimowa in 2017. Founded in 2012 by an entrepreneur and free-skier duo, Db is known for hyper-functional backpacks and other carriers.

Watches of Switzerland shares rise on signs of improving demand. The UK watch retailer saw a pickup in sales in its fiscal second quarter and reaffirmed its full-year financial guidance. Shares climbed as much as 8.5 percent in trading, paring its loss for this year to 26 percent.

Chinese cotton group urges Uniqlo and others to use Xinjiang fibre. The statement from the Xinjiang Uighur Autonomous Regionâs Cotton Association comes after Fast Retailing CEO Tadashi Yanai told BBC his company doesnât source cotton from the province.

THE BUSINESS OF BEAUTY

Ulta Beauty raises its annual profit forecast. Shares surged more than 11.5 percent in aftermarket trading after the announcement. The beauty retailer said it has seen strong engagement from younger shoppers seeking brands like as E.l.f. Beauty and Clinique by Estée Lauder for the holidays.

Shiseido stock plummets after growth plan underwhelms. Shares fell to their lowest in eight years after investors were underwhelmed by the companyâs plan to counteract a slump in China by boosting growth elsewhere.

Saudi cosmetics retailer Nice One announces $320 million IPO. Founded in 2016, Nice One is the latest in a series of IPOs across the kingdom, which have raised about $3 billion this year. Deal activity in the beauty sector is set to pick up in the region, with Dubai-based Huda Beauty also exploring the sale of its fast-growing perfume business.

Coty wins Swarovski beauty license. The first fragrances under the new license agreement are expected in 2026. French beauty firm Clarins previously produced perfumes under the Swarovski name.

PEOPLE

Unilever-Owned Nutrafol appoints new chief executive. Chief marketing officer Cindy Gustafson will take the supplement brandâs reins in 2025, succeeding co-founder Giorgos Tsetis.The company was founded in 2016 and was acquired by Unilever in 2022 for an estimated $1.2 billion.

MEDIA AND TECHNOLOGY

TikTok Shop triples Black Friday sales, topping $100 million. The app also drew a 165 percent annual increase in shoppers for the two days between Black Friday and Cyber Monday, the company said. These results show that intense regulatory scrutiny has done little to dampen the popularity of TikTok.

Compiled by Cathaleen Chen.